Australia’s controversial coal seam gas industry faces a deeply uncertain future.

RISING GAS PRICES, the pitched battle over CSG between farmers and miners, the US threat to LNG’s $13.2 billion export bonanza – are all set to spill over into the Federal election campaign. The Greens and Bob Katter are looking to capitalise.

The CSG industry’s hope of rivalling Qatar as the world’s biggest exporter of LNG could be snookered on a couple of fronts — the twin threat to Australia’s competitiveness in the face of a glut of natural gas from the US and the failure to overcome bitter resistance from farmers in key CSG tenements.

Thanks to world-leading extraction technology, oil and gas from the US’s massive shale reserves may see it regain its former “energy super power” title according to the Annual Energy Outlook for 2013.

After weighing up the economic impact on the domestic market, the US Department of Energy gave the green light on LNG exports to boost the flagging US economy.

Having warned that US shale production could be a game-changer two years ago, Deloittes now predicts U.S. LNG projects could displace Australian exports due to a surge in costs of constructing local LNG plants, The Australian reports.

Royal Dutch Shell’s Australian Chair, Ann Pickard, also weighed in on the threat to Australia’s competitiveness now that the US can deliver LNG to Tokyo Bay 20 per cent cheaper than Australia.

A spokesman for APPEA (the Australian Petroleum Production and Exploration Association) declined to comment when contacted by Independent Australia.

But the viability of the future LNG market is also threatened on the domestic front as farmers and (mostly) foreign-owned corporations go head to head in the competition for Australia’s riches: the $13.2 billion LNG export bonanza on the one hand, and Australia’s tightly-held food and fibre production regions on the other.

Both Arrow Energy (now owned by Royal Dutch Shell and PetroChina) and Santos Ltd (in partnership with Malaysian Petronas and French Total) are planning huge LNG facilities at Gladstone, Queensland.

So far, getting access to their major CSG reserves to fulfil feedstock requirements is proving a nightmare for the two energy giants

Delays due to concerns about fracking, toxic chemicals, depletion of water and loss of prime farmland are stalling progress and adding to costs.

The Liverpool Plains’ Gunnedah Basin in New South Wales is a major CSG resource for Santos. It is also one of Australia’s major cereal, oilseed and cotton production regions. Its prized black vertisol soil delivers two crops a year, even during droughts.

Likewise, Arrow’s Queensland CSG reserves are mostly concentrated on the Darling Downs’ fertile cropping lands, in particular, Cecil Plains — whereas Origin and QGC acreage sits further west on marginal or grazing country. Livestock can easily move around wells so getting graziers on board with the prospect of additional farm income is possible — not so cropping land with its 30-foot harvesters, ploughs and fragile soil.

Like the Liverpool Plains, the black alluvial soil makes it one of the world’s most valuable producers of cereals, oilseed and cotton.

These two tightly held, iconic agricultural regions, along with the Hunter Valley, have emerged as flashpoints in the hostilities.

Interviews with Santos, Arrow, QGC (owned by BG Group) and Origin (50:50 joint venture with ConocoPhillips), reveal that, so far, none have a single example of a large-scale cropping operation co-existing with CSG mining.

Last November, Santos’ quest to win the hearts and minds of New South Wales cropfarmers backfired when one of its TV ads depicting CSG co-existing with large-scale cropping was exposed by this author as a sham.

The ad, which was pulled the next day, was designed to garner social licence for Santos’ proposed Spring Ridge coal seam gas (CSG) operation in the Gunnedah Basin on the Liverpool Plains.

A blockade by local farmers ended shortly after when Santos agreed to suspend drilling activities pending completion of the Namoi Catchment Water Study.

Rosemary Nankivell, Liverpool Plains crop farmer and spokesperson for The Caroona Coal Action Group, explained about the cutting-edge skills required to plough the special vertisol soil of the floodplains:

“Our farmers use groundbreaking technology such as navigational satellites. If you start putting roads and pipes in, it will upset the surface flows along the plains and everything will get washed away.”

Santos’ Matthew Doman believes multi-well pads might be the way to go and drilling wells on the corners or boundaries of properties. But farmers remain skeptical, especially about aquifer depletion and subsidence from fracking.

Whilst Santos’ operation in New South Wales is still largely exploratory, Arrow Energy’s Surat Gas Project is dependent on Cecil Plains, its most concentrated reserve, as feedstock for its LNG contracts.

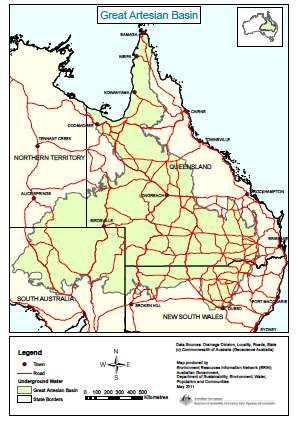

The Cecil Plains farmers are experts at managing the plains’ famous self-cracking black alluvial soil. Water from the Condamine Alluvium and Great Artesian Basin is applied with expert care to protect their intensive cropping operations.

Like the Liverpool Plains, its farmers are formidable guardians of the soil and water they regard as gold.

Cecil Plains large-scale crop operation.

Cecil Plains large-scale crop operation.

The Queensland government’s Strategic Cropping Land (SCL) policy relies on “reasonable efforts to avoid and minimise any impacts on SCL”. Reaching an agreement on what is “reasonable” has resulted in a stalemate for Arrow.

At the end of August, sixty Cecil Plains farmers met with Arrow, rejected its ‘co-existence’ commitment, burnt the document and threatened blockades if Arrow tried sending in drilling rigs.

Cecil Plains crop farmer and Save Our Darling Downs spokesperson, Ruth Armstrong, says the “co-existence” model is flawed.

“One party benefits to the detriment of the other. If they can’t get Cecil Plains, it makes their Surat project unviable,” she said.

Graham Clapham is a third generation farmer, running a 4,700 hectare intensive, irrigated cropping operation on the Cecil Plains.

“We have no obligation to Arrow which is now foreign-owned by Royal Dutch Shell and PetroChina, but we do have an obligation to protect Australia’s long term food and water interests,” he told Independent Australia.

Like Santos, Arrow is confident that agricultural and coal seam gas industries can co-exist thanks to input from its two community committees.

“Arrow is technically demonstrating this through new pitless drilling, multi-well pads and flexible well locations,” said an Arrow spokesperson.

As in New South Wales, local farmers remain convinced. Although problematic fracking is not required with gas seams near the surface, they fear the fresh ground water, also close to the surface, will be depleted.

Arrow has 500 landholder agreements in place but Carmel Flint, of Lock the Gate Alliance points out that they still need 1,500.

“Cecil Plains has up to 40 per cent of its gas resources. We predict Arrow’s plans for an LNG export plant are never going to be realized. They should walk away from this risky venture now before they lose even more money on it,” she said.

Two parties are looking to wedge the two major parties on coal seam gas. Katter’s Australian Party, which has already taken its first LNP scalp − and the Australian Greens − have vowed to take on mining interests to ward off CSG on prime agricultural land.

They plan to offer a real alternative to disgruntled country as well as city voters. Both will field candidates in all 150 House of Representative seats as well as all states and territories in a plan to wedge Labor and LNP on CSG.

Federal member for Kennedy, Bob Katter, says he’s been on the side of the farming community for forty years. His Australian Party Coal Seam Gas Policy will exempt productive land from mining, restore property rights, prohibit drilling/fracking on the Great Artesian Basin and implement a twelve-month moratorium on all CSG projects.

Australian Greens’ leader, Senator Christine Milne, is convinced CSG is a huge election issue.

“It’s extremely serious from a number of points of view. We shouldn’t be starting a new fossil fuel industry at the end of the fossil fuel age. Issues of this century are food and water security,” Milne, who points out she grew up on a dairy farm, said.

Milne is proud of the Greens’ initiatives, especially the $1 billion Biodiversity Fund to help farmers store carbon and build environment resilience.

The Greens are calling for a moratorium on CSG extraction and promise to introduce a trigger under the Environment Protection and Biodiversity Conservation Act (EPBCA) to assess impacts on agricultural land and groundwater as well as fugitive emissions.

There have been frictions also at state level.

The iconic Margaret River food production region in Western Australia has been quarantined from mining in response to political pressure. Last August, without warning, the Victorian state government announced a ban on fracking following dismal internal polling figures. And in New South Wales, where the ban on fracking was lifted by the O’Farrell government, the Nationals have split with the Liberals demanding strategic farmland be placed off limits.

Even in France, where controversial nuclear power is the main energy source, fracking has been banned in response to public concerns.

Critics of CSG also point to the global concern around food and water security.

One of the UN’s and Oxfam’s expert sources is Lester Brown, an environmental analyst and president of the Earth Policy Institute in Washington.

Brown writes in his new book, Full Planet, Empty Plates:

In this era of tightening world food supplies, the ability to grow food is fast becoming a new form of geopolitical leverage. Food is the new oil. Land is the new gold.

The Federal Government’s white paper, Australia in the Asian Century, predicts food exports to Asia will be 70 per cent higher by 2050 from 2007 levels due to demand.

The Government’s National Food Plan Green Paper is now being developed to foster ‘…a sustainable, globally competitive, resilient food supply.’

The National Food Plan does acknowledge the impact of coal seam gas and amendments to the EPBCA have established a new “independent scientific committee” to examine CSG and large coal mining development.

But Greens’ leader Christine Milne is highly critical of the plan.

“As long as we can get adequate cheap food, it satisfies the Government’s idea of food security. For the Greens, it’s about securing agricultural land and water to maximize food production,” she said.

Many of the areas slated for CSG production are directly above the Great Artesian Basin, one of the world’s largest natural underground water reservoirs covering about 22 per cent of Australia’s land mass.

Dr Vincent Post is a hydrogeologist and chief investigator at the National Centre for Groundwater Research and Training. He warns that water levels may not be renewable — a key argument by the anti-CSG farming lobby.

Dr Vincent Post is a hydrogeologist and chief investigator at the National Centre for Groundwater Research and Training. He warns that water levels may not be renewable — a key argument by the anti-CSG farming lobby.

Political critics are also rallying around residential landholder rights, rising gas prices, scarcity of supply and health concerns from fugitive methane emissions.

The CSG Golden Goose – which was supposed to herald a new energy source for the domestic market as well as a lucrative export opportunity – has, unfortunately, taken flight to distant shores where LNG sales return fatter profits. Unsurprisingly, the Australian Energy Regulator’s report in December that LNG exports will drastically increase domestic gas prices, brought little cheer at Christmas.

With gas prices predicted to double due to dwindling supplies, angry voters will be joining beleaguered manufacturers and farmers in demanding government action.

In New South Wales, where current supplies of CSG from Queensland will soon be hoovered up by the huge LNG plants at Gladstone, panic has set in. According to an Australian Financial Review report, AGL’s solution to the crisis is expansion of their Camden operation into residential areas.

Horrified Camden residents faced with the prospect of the land under their homes honeycombed by hundreds of gas wells will get little sympathy from the federal government or opposition. Both endorse massive expansion of the CSG industry as the key to price and supply problems as outlined in the Energy White Paper.

Beyond the issues of water and food security, landholder rights and rising gas prices, health concerns about methane emissions have highlighted the huge experiment that is being played out on the Australian public.

Reports suggesting a tax bill that could run into billions of dollars through carbon tax liabilities for “fugitive” emissions will send further ripples through an already nervous share market.

Arrow infrastructure in close proximity to arable land.

Arrow infrastructure in close proximity to arable land.

With one contentious issue after another lining up like dominoes, this year’s Federal election is shaping up as a potential game-changer.

Only half the Senate has to go to the polls so, six of the Greens’ nine senators won’t face re-election until 2016 (or earlier in the event of a double dissolution). That’s just three seats to defend out of nine.

The Katterites are sure to pick up a seat in Queensland. Predicting which way they’ll jump with a mix of policies from Labor and the old Country Party grab-bag may confound the pundits but not where they stand on CSG and Australia’s prime farmland.

If the polls continue to close and we have another government without a clear majority, the Greens and Katterites hope to be in a strong bargaining position on CSG and will play hardball in return for crucial support on other bills.

Holding the balance of power after the 2013 Federal election is where the rubber could start hitting the road on the political future of CSG.

(At the time of writing, the author held shares in Santos and Origin as well as a couple of small CSG start-ups. Originally published in Independent Australia on 3 February 2013. An abridged version of Sandi Keane’s report appeared in two parts in Crikey on 30 January 2013 and 31 January 2013.)

You must be logged in to post a comment.